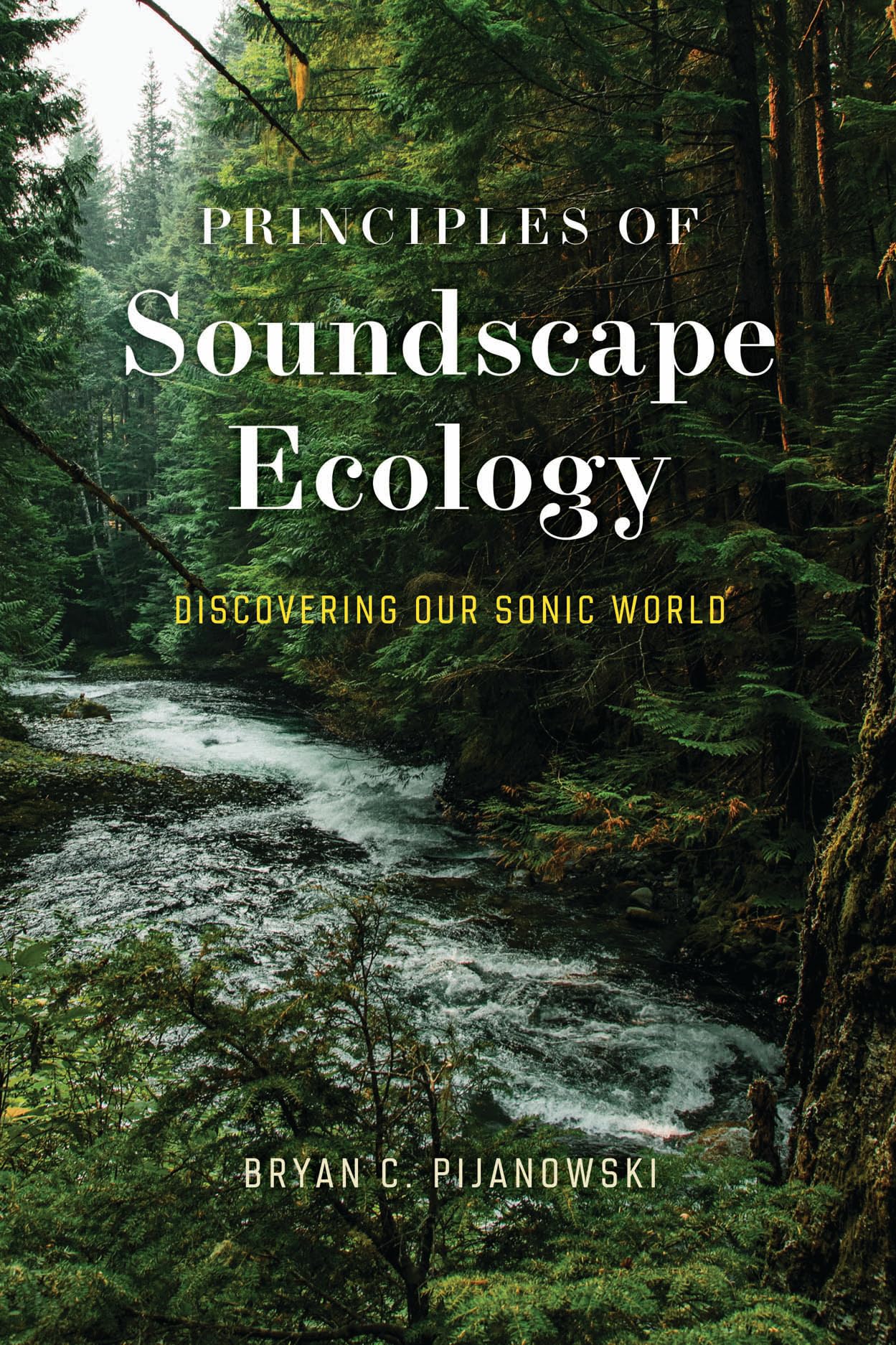

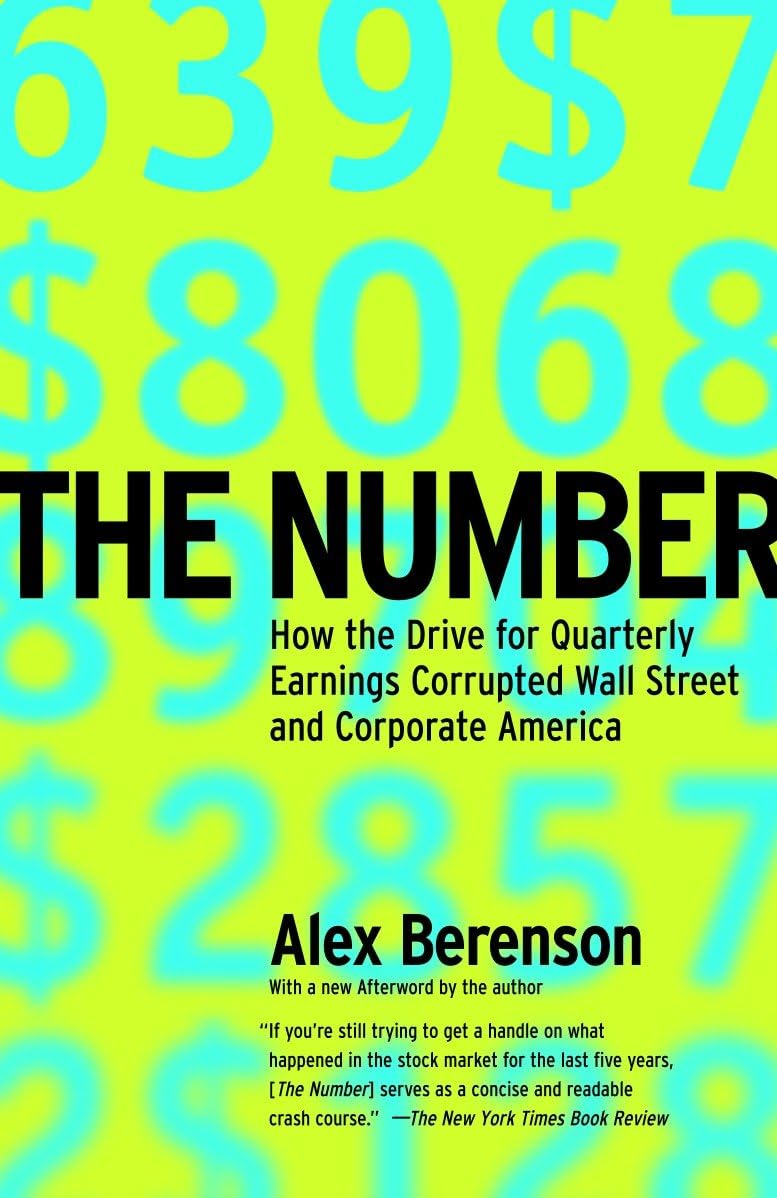

The Number: How the Drive for Quarterly Earnings Corrupted Wall Street and Corporate America

$17.99

| Brand | Alex Berenson |

| Merchant | Amazon |

| Category | Books |

| Availability | In Stock |

| SKU | 0812966252 |

| Color | Yellow |

| Age Group | ADULT |

| Condition | NEW |

| Gender | UNISEX |

About this item

The Number: How the Drive for Quarterly Earnings Corrupted Wall Street and Corporate America

With a new Afterword by the author and a new Foreword by Mark Cuban In this commanding big-picture analysis of what went wrong in corporate America, Alex Berenson, a top financial investigative reporter for The New York Times , examines the common thread connecting Enron, Worldcom, Halliburton, Computer Associates, Tyco, and other recent corporate scandals: the cult of the number. Every three months, 14,000 publicly traded companies report sales and profits to their shareholders. Nothing is more important in these quarterly announcements than earnings per share, the lodestar that investors—and these days, that’s most of us—use to judge the health of corporate America. earnings per share is the number for which all other numbers are sacrificed. It is the distilled truth of a company’s health. Too bad it’s often a lie. Alex Berenson’s The Number provides a comprehensiv, brutally factual overview of how Wall Street and corporate America lost their way during the great bull market that began in 1982. With wit and a broad historical perspective, Berenson puts recent corporate accounting (or accountability) disasters in their proper context. He explains how the wheels came off the wagon, giving readers the information and analysis they need to understand Enron, Tyco, WorldCom, Halliburton, and the rest of the corporate calamities of our times. “Alex Berenson, a whip-smart New York Times business reporter, is [a] wisecracking play-by-play commentator. In The Number , he offers a compelling account of how many large-number corporations went astray in the late 1990s. . . . Berenson knows this material cold, and he has a way with a phrase.” — The Washington Post “Berenson’s book is about far more than one financial concept or dictionary definition. It is a well-written, informative, fact-filled review of how we got into this mess. More, it’s the sort of book those of us who plan to be around the financial-services industry for a long time can take down from our bookshelves years from now, during the next bubble, and say to the younger folks, ‘Let me tell you something, this has happened before.’” — The Mercury News “If you’re still trying to get a handle on what happened in the stock market for the last five years,[ The Number ] serves as a concise and readablecrash course.” — The New York Times Book Review In this commanding big-picture analysis of what went wrong in corporate America, Alex Berenson, a top financial investigative reporter for The New York Times , examines the common thread connecting Enron, Worldcom, Halliburton, Computer Associates, Tyco, and other recent corporate scandals: the cult of the number. Every three months, 14,000 publicly traded companies report sales and profits to their shareholders. Nothing is more important in these quarterly announcements than earnings per share, the lodestar that investors?and these days, that?s most of us?use to judge the health of corporate America. earnings per share is the number for which all other numbers are sacrificed. It is the distilled truth of a company?s health. Too bad it?s often a lie. The Number provides a comprehensive overview of how Wall Street and corporate America lost their way during the great bull market that began in 1982. With fresh insight, wit, and a broad historical perspective, Berenson puts the accounting fraud of the past three years in context, describing how decades of lax standards and shady practices contributed to our current economic troubles. As the bull market turned into a bubble, Wall Street became utterly focused on ?the number,? companies? quarterly earnings. Along the way, the market lost track of what companies are really supposed to do?build profitable businesses with sustainable futures. With their pay soaring, and increasingly tied to their companies? shares, executives were more than happy to give Wall Street the predictable earnings reports it wanted, what-ever the reality of their businesses. Accountants, analysts, money managers, and individual investors played along, while the Securities and Exchange Commission found itself overwhelmed and underequipped to cope with the earnings game. The Number offers a unified vision of how today?s accounting scandals reflect a broader system failure. As long as investors remain too focused on the number, companies will find ways to manipulate it. Alex Berenson gives anyone who has ever invested in?or worked for?a public company the tools necessary to see beyond the cult of the number, understand accounting and its limits, and recognize patterns that can lead to fraud. After two decades of stock market hype, The Number offers a welcome dose of truth about the way Wall Street and corporate America really work. From the Hardcover edition. With a new Afterword by the author and a new Foreword by Mark Cuban In this commanding big-picture analysis of what went wrong in corporate America, Alex Berenson, a top financial investigative reporter for "Th

| Brand | Alex Berenson |

| Merchant | Amazon |

| Category | Books |

| Availability | In Stock |

| SKU | 0812966252 |

| Color | Yellow |

| Age Group | ADULT |

| Condition | NEW |

| Gender | UNISEX |

Similar Products

Compare with similar items

Celebrating Philip: Baby Boy Gift & Pers... |

Vintage Shade: Salty Classic Ladies: Adu... |

Hey I Found Your Nose Tee S White... |

Scary Mysteries and Spooky Bedtime Stori... |

|

|---|---|---|---|---|

| Price | $19.95 | $8.97 | $35.26 | $10.49 |

| Brand | Suzanne Marshall | Color Me Naughty | Sentinel Threads | Eliza Lacroix |

| Merchant | Amazon | Amazon | Inspire Uplift | Amazon |

| Availability | In Stock | In Stock | In Stock | In Stock |