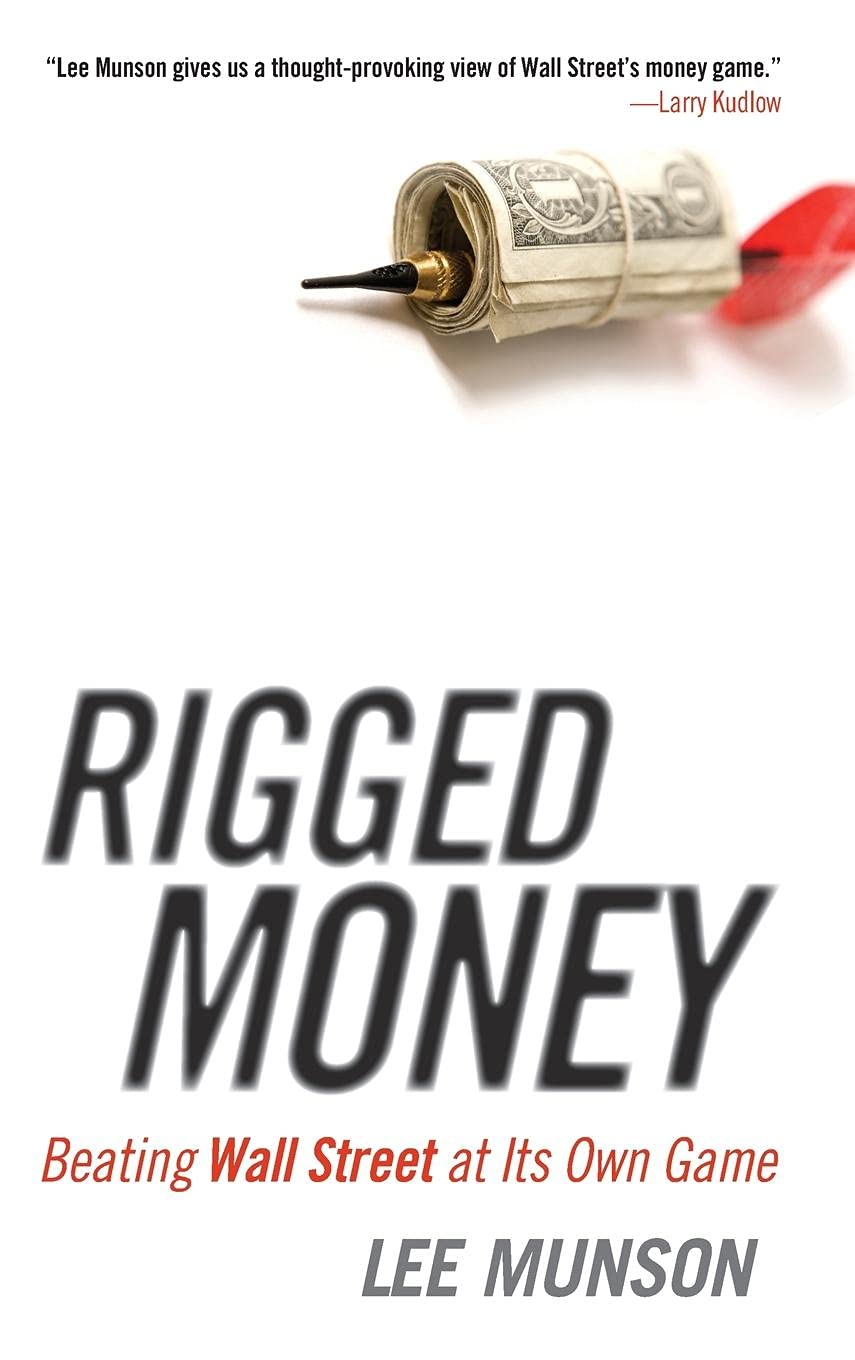

Rigged Money: Beating Wall Street at Its Own Game

$18.00

| Brand | Lee Munson |

| Merchant | Amazon |

| Category | Books |

| Availability | In Stock |

| SKU | 1118099680 |

| Age Group | ADULT |

| Condition | NEW |

| Gender | UNISEX |

| Material | Cellulose-based or similar non-woven material |

| Google Product Category | Media > Books |

| Product Type | Books > Subjects > Business & Money > Investing > Introduction |

About this item

Rigged Money: Beating Wall Street at Its Own Game

Today's financial landscape and what Wall Street doesn't want you to know Rigged Money is based on one simple truth: Wall Street needs money from Main Street, not the other way around. The financial industry has convinced the general public that investing across different asset classes is the only way to protect wealth, but this is an outdated rule that no longer applies. Since asset classes―small caps, large caps, international investments, gold, and bonds―now overlap when it comes to risk and volatility parameters, the diversification effect is gone. That's exactly what Wall Street doesn't want you to know―that the rules of the game have changed. Risk Isn't Constant: Pie charts lie when it comes to accurately describing the risk of stocks and bonds - Dividends Are No Silver Bullet: They are designed to entice investors rather than to increase a company's value or your net worth - Buy and Hold is Dead: The financial world (and all the companies and securities in it) moves too quickly and is changing too often for this theory to hold true today - Gold Is Not an Investment: Gold is today's currency of fear, and this fear is driven by escalating government debt An unflinching look at this new financial world, Lee Munson's Rigged Money arms today's investors with the simple, smart, and clear advice needed to level the playing field. To understand the economy you have to understand one simple, but unspoken, truth: Wall Street needs money from Main Street, not the other way around. Keeping this secret from the public has been an essential part of the development of the American economy for over four hundred years, but now that you know it--and with advice from Wall Street insider-turned-realist Lee Munson--you have the power to protect yourself and your money. Rigged Money: Beating Wall Street at Its Own Game explains in detail how the financial industry has systematically worked to convince the public that investing across different asset classes is the only way to protect wealth. At one point this was probably sage advice, but today it's an outdated rule more likely to bring disaster than success. Since asset classes--from small caps and international stocks to gold and bonds--now overlap when it comes to risk and volatility parameters, the diversification effect is gone, and with it, any reason for spreading your money around. It's this change in the financial landscape, and the rules of the game, that Wall Street doesn't want you to know about, and that this book discusses. Revealing the truth about the system while arming you with the simple, smart, and clear advice that you need to go head-to-head with the financial giants, Rigged Money provides advice to investors on what Wall Street is doing behind your back and how you can use the same techniques and knowledge to level the playing field. To understand the economy you have to understand one simple, but unspoken, truth: Wall Street needs money from Main Street, not the other way around. Keeping this secret from the public has been an essential part of the development of the American economy for over four hundred years, but now that you know it―and with advice from Wall Street insider-turned-realist Lee Munson―you have the power to protect yourself and your money. Rigged Money: Beating Wall Street at Its Own Game explains in detail how the financial industry has systematically worked to convince the public that investing across different asset classes is the only way to protect wealth. At one point this was probably sage advice, but today it’s an outdated rule more likely to bring disaster than success. Since asset classes―from small caps and international stocks to gold and bonds―now overlap when it comes to risk and volatility parameters, the diversification effect is gone, and with it, any reason for spreading your money around. It’s this change in the financial landscape, and the rules of the game, that Wall Street doesn’t want you to know about, and that this book discusses. Revealing the truth about the system while arming you with the simple, smart, and clear advice that you need to go head-to-head with the financial giants, Rigged Money provides advice to investors on what Wall Street is doing behind your back and how you can use the same techniques and knowledge to level the playing field. LEE MUNSON worked as a speculative tradervduring the dot-com boom and bust until he had an epiphany and began to question everything about his approach to investments. Realizing that Wall Street is a game that isn’t always played to give investors a fair chance at winning, Munson went on to form an asset management firm, Portfolio LLC, in New Mexico that is ranked as one of the fastest growing firms in the country. A frequent guest on CNBC’s The Kudlow Report , he is a contributor for TheStreet.com and is quoted in numerous financial publications such as the Wall Street Journal, SmartMoney, and the Kiplinger Report .

| Brand | Lee Munson |

| Merchant | Amazon |

| Category | Books |

| Availability | In Stock |

| SKU | 1118099680 |

| Age Group | ADULT |

| Condition | NEW |

| Gender | UNISEX |

| Material | Cellulose-based or similar non-woven material |

| Google Product Category | Media > Books |

| Product Type | Books > Subjects > Business & Money > Investing > Introduction |

Similar Products

Compare with similar items

Cheeky Christmas: Coloring Book for Adul... |

19 Easy Vegan Recipes for Beginners.: He... |

Rocky Patel Dark Star - Box of 20 Sixty... |

Us Against Them: An Oral History of the ... |

|

|---|---|---|---|---|

| Price | $9.99 | $6.99 | $225.99 | $21.00 |

| Brand | Anna Rose | William B. Gomes | Rocky Patel | Robin McMillan |

| Merchant | Amazon | Amazon | Thompson cigar | Amazon |

| Availability | In Stock | In Stock | In Stock | In Stock Scarce |